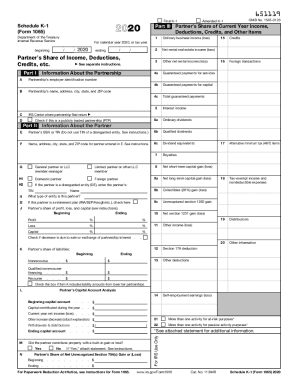

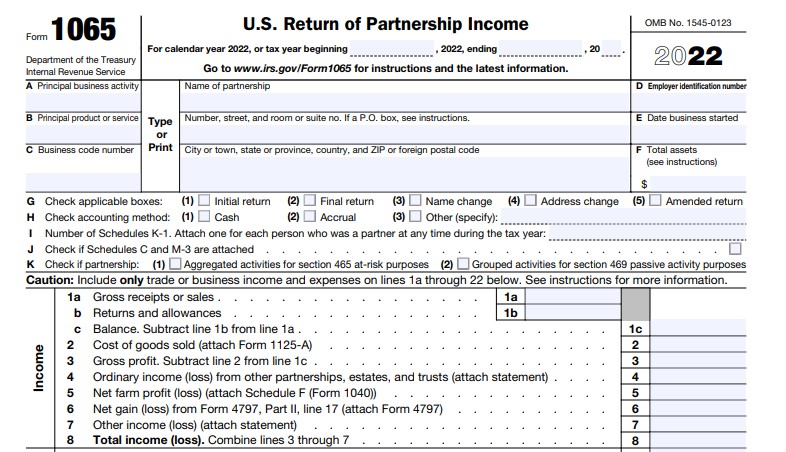

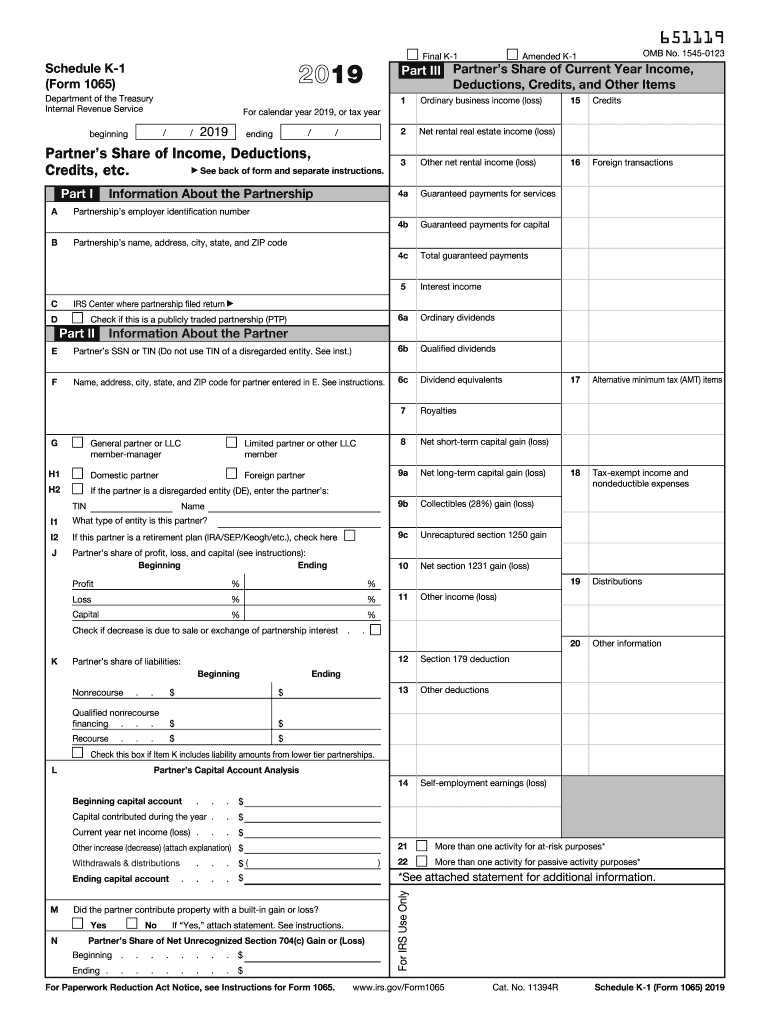

2024 Form 1065 Schedule K-1 – Schedule K-1 Tax Form for Inheritance vs. Schedule K-1 (Form 1065) Schedule K-1 can refer to more than one type of tax form and it’s important to understand how they differ. While Schedule K-1 . Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a .

2024 Form 1065 Schedule K-1

Source : lili.co2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable

Source : schedule-k-1.pdffiller.com1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

Source : www.nelcosolutions.comIRS Schedule K 1 (1065 form) | pdfFiller

Source : www.pdffiller.com1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

Source : www.nelcosolutions.comIRS Instruction 1065 Schedule K 1 2020 2024 Fill out Tax

Source : www.uslegalforms.comSchedule K 1 (Form 1065) Partnership (Overview) – Support

Source : support.taxslayer.comIRS Schedule K 1 (1065 form) | pdfFiller

Source : www.pdffiller.comForm 1065 Step by Step Instructions (+Free Checklist) for 2024

Source : fitsmallbusiness.comIrs k1 forms: Fill out & sign online | DocHub

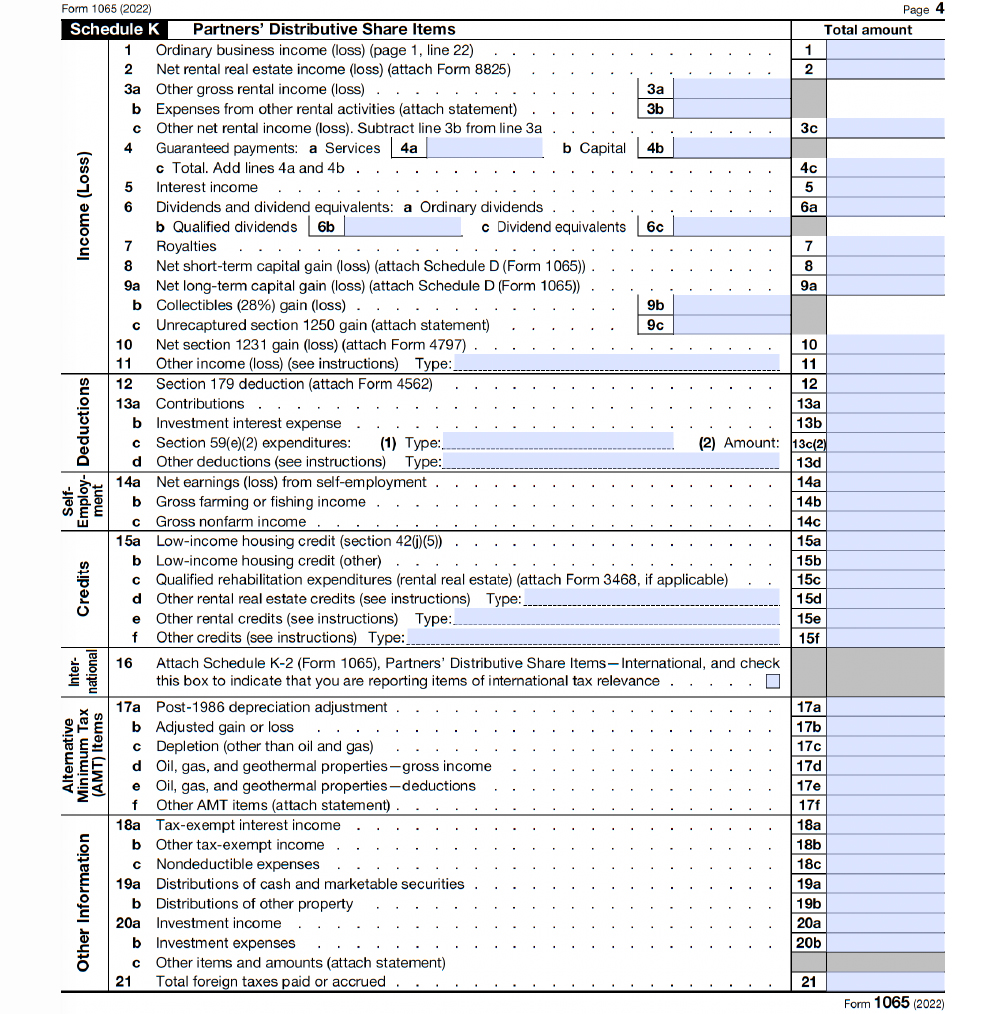

Source : www.dochub.com2024 Form 1065 Schedule K-1 Form 1065 Instructions: U.S. Return of Partnership Income: The partnership must file one Form 1065 to represent the tax details of the business for the tax year. This form is then used to prepare each Schedule K-1 for the partnership’s owners to claim . Complete Schedule K, a schedule of income and expenses that are reported on the shareholders K-1, on Page 4 of Form 1065. Complete Schedule L, the balance sheet, on Page 5 of Form 1065. .

]]>